The global energy crisis has prompted investors to redefine their business strategies. As energy security concerns threaten to push net zero off the agenda, how can businesses balance the energy trilemma?

New research from Baker Hughes finds that the energy security crisis, and the resulting high demand for natural gas from countries other than Russia, is making natural gas and LNG an investment priority for energy companies and industrial companies. In the annualEnergy Transition Pulse surveyof 555 business leaders across 21 countries, 57 per cent are planning to make new investments in natural gas or have already done so. A further 65 per cent say that energy price volatility expedited their final investment decision.

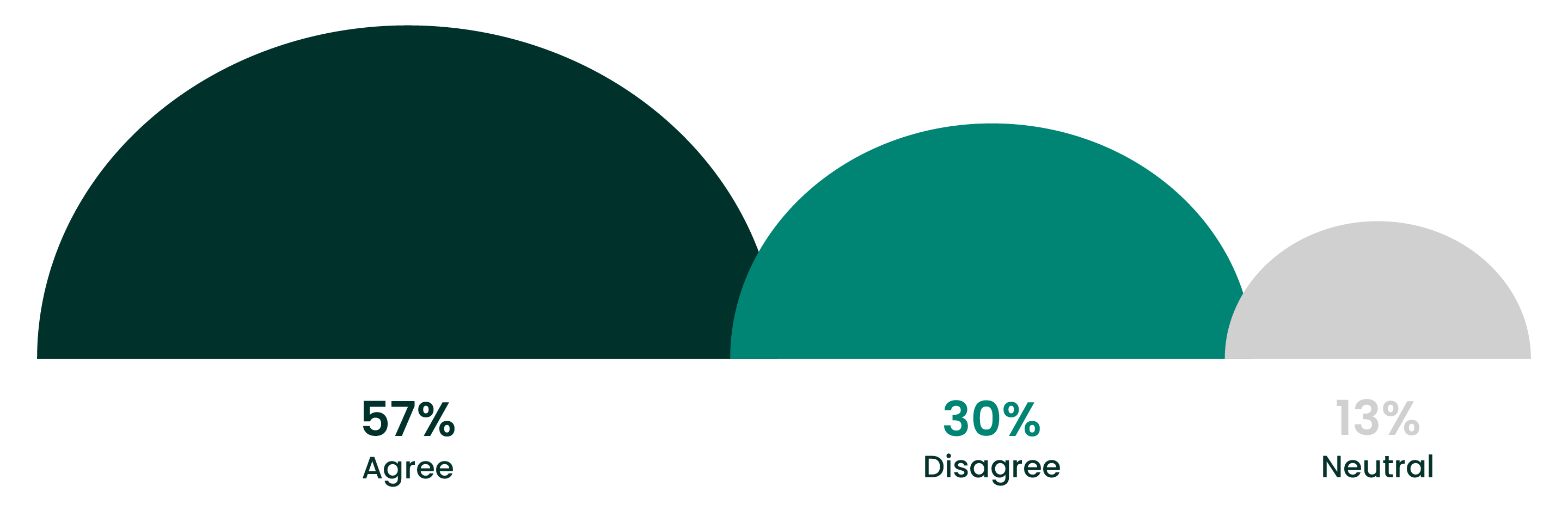

The majority of respondents are investing or planning to invest in natural gas/LNG as a result of the energy security crisis

To what extent do you agree or disagree with the following statement about your organisation? We’ve made or are planning to make new investments in natural gas/LNG as a result of the energy security crisis.

Woodside Energy is one of them. In Western Australia it is expanding gas processing capacity with the construction of a second LNG train at the existing Pluto LNG site.

“Markets were tight even before Russia invaded Ukraine,” says Meg O’Neill, CEO of Woodside Energy. “For the global supply and demand balance for both oil and LNG, and increasingly hydrogen, we do expect that the world is going to need all of those products in the time period where those assets will come online.”

Many companies are also seizing opportunities in renewable energy such as wind and solar power. Nearly half of companies (49 per cent) in the Baker Hughes research say they have made or are planning to make investments in renewable energy as a direct result of the energy crisis.

Chemicals multinational Solvay is another company trying to diversify its energy supply and lower emissions in line with net zero targets.

“We are using LNG and alternative fuels, while really trying to live with less gas,” says Ilham Kadri, CEO and president of the executive committee of Solvay. As the Russia-Ukraine crisis brings into focus the need to develop alternative energy sources sooner rather than later, investment in new energy ecosystems has become critical.

“The crisis is an opportunity to build that infrastructure faster, at scale and at the right cost. This is vital for the competitiveness of the European industrial footprint,” says Kadri.

Businesses and policymakers will have to spread their bets

The disruption to global energy markets has shown policymakers that they need to reduce their dependency on a single fuel source. The EU, for example, is taking steps to diversify its energy supply and sources with a €210bn plan to accelerate the energy transition.[1]其措施包括购买天然气,液化天然气and hydrogen for all member states, increased production of biomethane and a rapid rollout of solar and wind projects. The US is making similar efforts with the Inflation Reduction Act, which will invest about $369bn in energy security and climate change programmes over the next 10 years.[2]

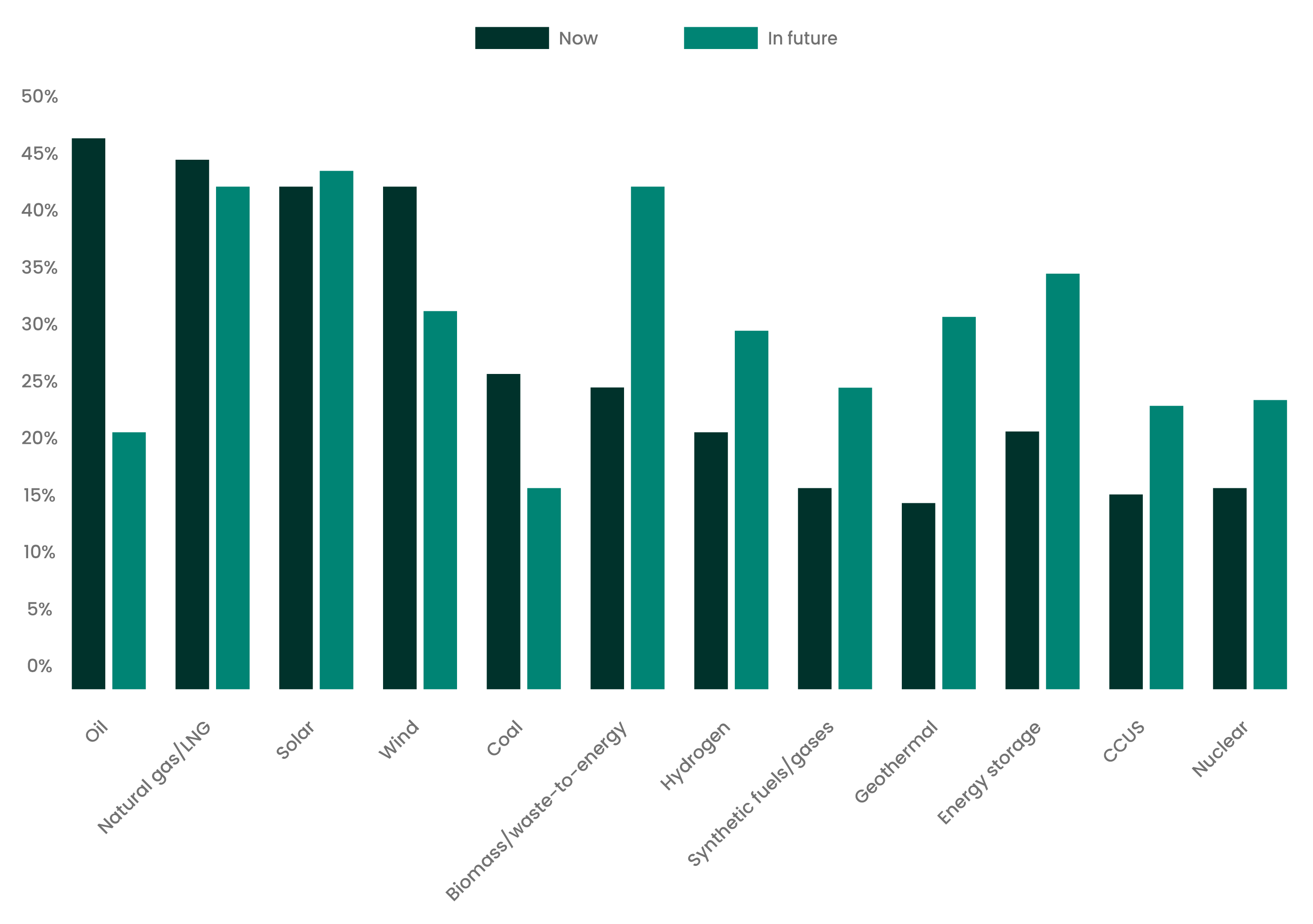

Among the options for diversification given in the Baker Hughes research, solar energy, natural gas/LNG, and biomass/waste-to-energy are tipped by business leaders to see the most use or investment, with about four in 10 companies expecting to prioritise these in the future. A further 35 per cent say they will be investing in or using energy storage, 32 per cent in wind and 31 per cent in geothermal.

Use of and investment in biomass, energy storage, geothermal and hydrogen are expected to increase the most in the future compared with today.

Which of the following energy sources/technologies do you expect to prioritise the use of, or investment in, in the future?

The transition needs technology investment

一个成功的能源转型需要支持infrastructure. To reach the Paris Agreement’s goal of net zero by 2050, companies must also invest in technologies and applications such as hydrogen and carbon capture, utilisation and storage (CCUS) that can help reduce emissions.

“If we are going to achieve the goals of the Paris Accord, we need to capture, store and utilise CO2,” says Lorenzo Simonelli, chairman and CEO at Baker Hughes. “We are developing great ways to take CO2 from the atmosphere and put it to use as an offset relative to net zero. Hydrogen is also very exciting as a cleaner fuel used to produce additional compounds including ammonia and we are investing heavily in turbines that can make and distribute hydrogen.”

The good news is that momentum for decarbonisation persists, and companies believe they are making progress already with existing technology and through greater efficiencies: nearly six in 10 business leaders in the research say their organisations’ net zero preparedness is still on track. But to make the leap to net zero, they will need to rethink their strategies, supplementing natural gas with additional energy sources and technologies.

Content produced by FT Longitude, the specialist marketing & research division of the Financial Times Group.

Energy Forward Stories

Sign up to stay up to date on the latest innovations and people shaping the future of our industry.